30+ How much could i lend mortgage

Apply Online Get Pre-Approved Today. A mortgage loan term is the maximum length of time you have to repay the loan.

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

Check Your Eligibility for a Low Down Payment FHA Loan.

. Find out how much you could borrow. Common mortgage terms are 30-year or 15-year. Looking For A Mortgage.

Compare Mortgage Loan Lender Offers for 2022 000 Federal Reserve Rate Top Choice. Take Advantage And Lock In A Great Rate. Skip The Bank Save.

30 Year 2000000 Mortgage Loan. The length by which you agree to pay back the home loan. This is what the lender charges you to lend you the money.

Its A Match Made In Heaven. Less than half of economic. Answer Simple Questions See Personalized Results with our VA Loan Calculator.

Were Americas 1 Online Lender. Call us on 1800 20 30 35. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial situation.

Compare Apply Directly Online. Interest ratethe percentage of the loan. Fill in the entry fields and click on the View Report button to see a.

What More Could You Need. Find A Great Lender For Your Needs And Get One Step Closer To Moving Into Your Next Home. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

Is a 30-year fixed-rate mortgage right for you. How much money could you save. New lending rules rolled out in January 2014.

Apply Easily And Get Pre Approved In a Minute. Were Americas 1 Online Lender. Most fixed-rate mortgages are for 15 20 or 30-year terms.

This can be anywhere from 10 years to 30 years but entering 30 years will have the lowest payments and enable you to qualify for the highest loan amount. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. A shorter period such as 15 or 20 years typically includes a lower interest rate.

The maximum amount you can borrow with an FHA-insured. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Its A Match Made In Heaven.

For this reason our calculator uses your. The first step in buying a house is determining your budget. Some lenders may have a minimum amount you must borrow.

Ad 2022s Best Mortgage Lenders Comparison. Longer terms usually have higher rates but lower. Calculate Your Monthly Loan Payment.

Ad Top-Rated Mortgage Lenders 2022. See If Youre Eligible for a 0 Down Payment. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Use Our Comparison Site Find Out Which Lender Suites You The Best. Take the First Step Towards Your Dream Home See If You Qualify. 1800 20 30 35.

Ad Compare Best Mortgage Lenders 2022. Looking For A Mortgage. This calculates the monthly payment of a 2 million mortgage based.

Bank had a minimum home equity loan amount of 15000 in July 2022. Ad Lender Mortgage Rates Have Been At Historic Lows. Just fill in the interest rate and the payment will be calculated automatically.

The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type. Ad First Time Home Buyers. There are clear rules around how much money you can lend for a mortgage.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. See How Much You Can Save.

What More Could You Need. Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. This mortgage calculator will show how much you can afford.

The Loan Amount. Buying My First Home.

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

Lnj9bfpd78vswm

50 30 20 Budget Rule Free Budget Spreadsheet Healthy Wealthy Skinny Money Management Advice Budgeting Money Saving Money Budget

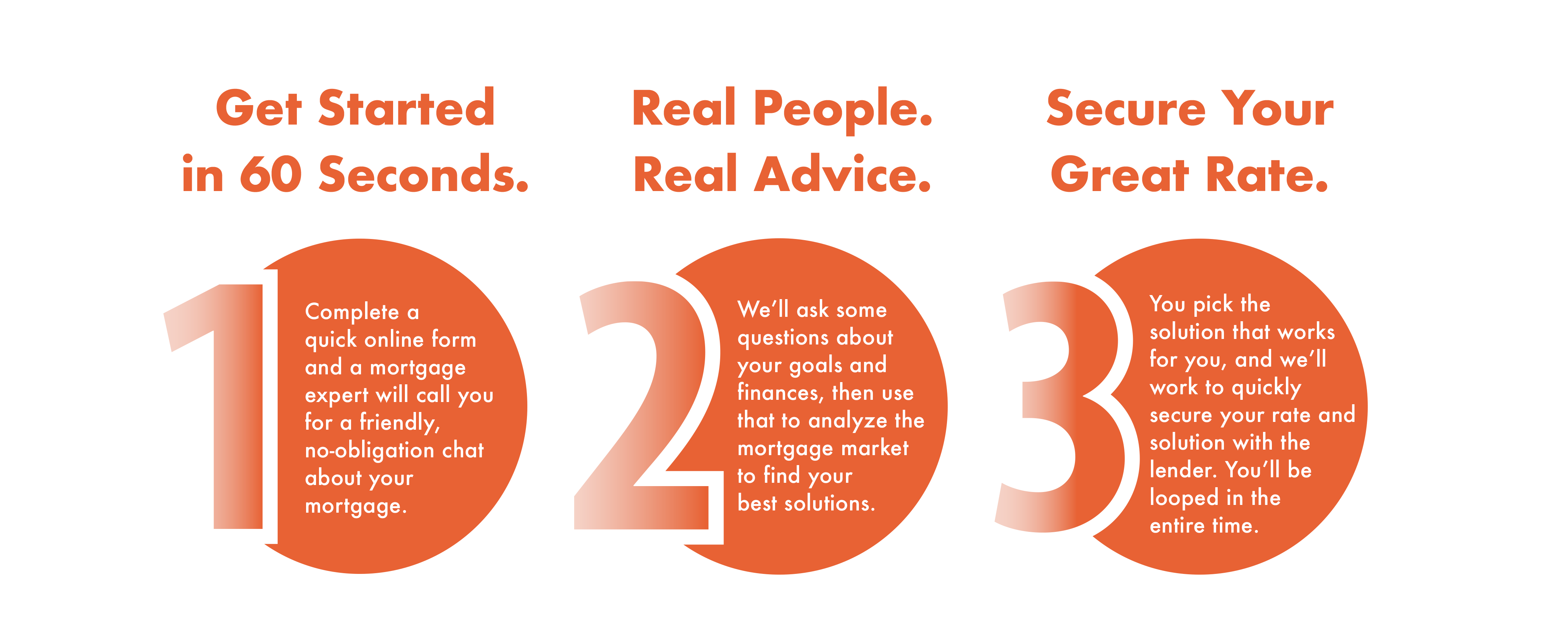

Mortgage Renewals Transfers In Toronto Outline Financial

How To Quickly Remove Mortgage Lates From Your Credit Report

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Pin On Money

Ontario Mortgage Rates From 30 Ontario Lenders Wowa Ca

Mortgage Renewals Transfers In Toronto Outline Financial

Pin By Marquesf Fmonica On Trucs Et Astuces Money Saving Challenge Saving Money Budget Money Saving Strategies

Is It Possible To Get A Loan For A House Or An Apartment And Then Rent It Out Until It Pays For Itself Even If It Takes Like 20 Years Quora

Top 10 Mortgage Mistakes To Avoid For A Smooth Home Loan Experience

Mac Mcdonald Mortgage 30 Years Of Experience Home Facebook

How To Calculate Your Fire Number When You Have A Mortgage With Spreadsheet R Financialindependence

Residential Msr Market Update September 2019 Miac Analytics

Why Do We Allow People To Take 30 Years To Pay Off Mortgages When We Sell Them A House Quora